Overview of Cases Covered by Our QuickBooks Integration

From simplifying invoicing and payroll processes to enhancing financial reporting, this overview highlights how our integration supports various aspects of your business, ensuring smoother workflows and better decision-making.

1. Simple Setup Guide QuickBooks

2. Overview of Cases Covered by Our QuickBooks Integration

Cases

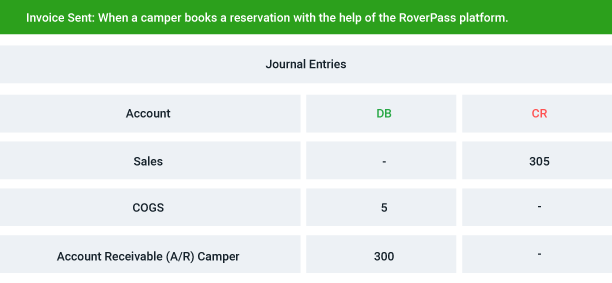

- Invoice Sent: When a camper books a reservation with the help of the RoverPass platform.

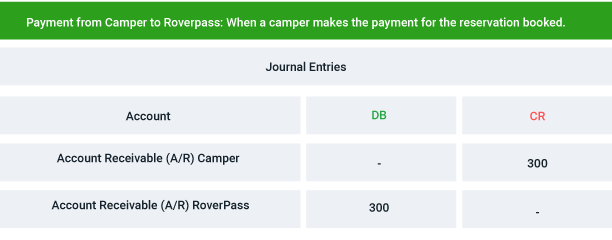

- Payment from Camper to Roverpass: When a camper makes the payment for the reservation booked.

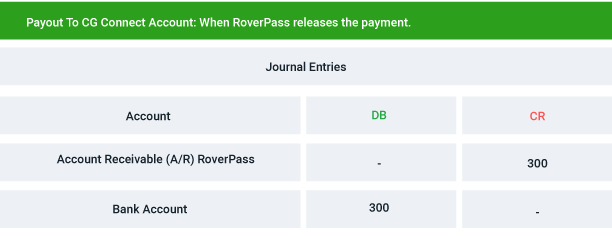

- Payout To CG Connect Account: When RoverPass releases the payment.

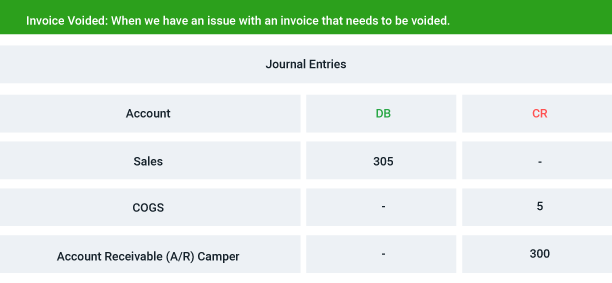

- Invoice Voided: When we have an issue with an invoice that needs to be voided.

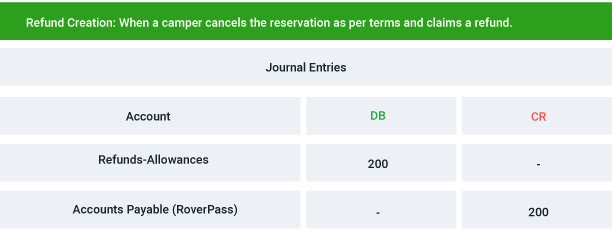

- Refund Creation: When a camper cancels the reservation as per terms and claims a refund.

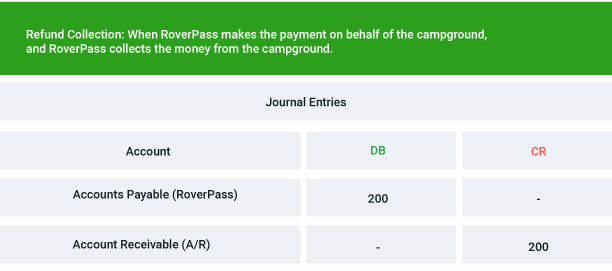

- Refund Collection: When RoverPass makes the payment on behalf of the campground, and RoverPass collects the money from the campground.

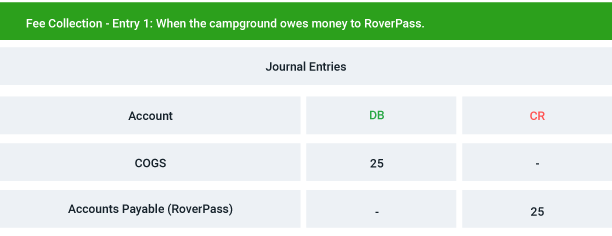

- Fee Collection - Entry 1: When the campground owes money to RoverPass.

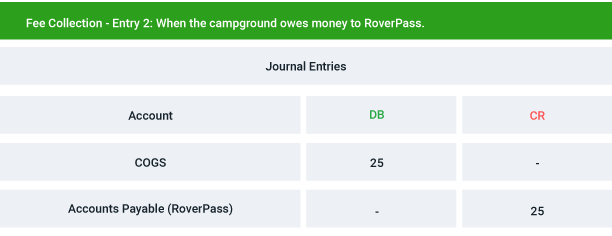

- Fee Collection - Entry 2: When the campground owes money to RoverPass.

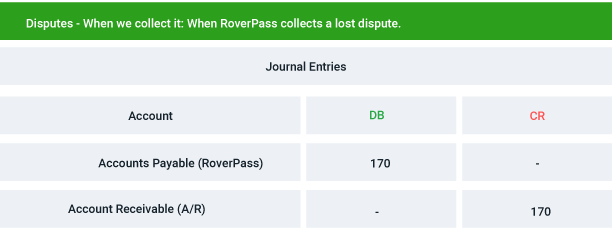

- Disputes - When we collect it: When RoverPass collects a lost dispute.

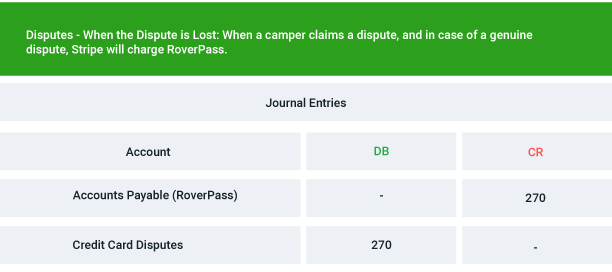

- Disputes - When the Dispute is Lost: When a camper claims a dispute, and in case of a genuine dispute, Stripe will charge RoverPass.

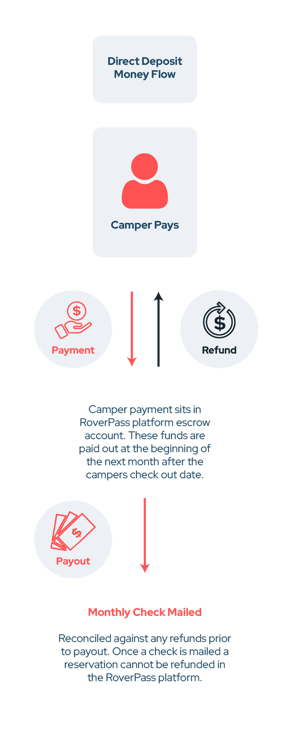

- TRX Diagram